Risk pools, to put it mildly, vary greatly. Few are structured and operated according to truly professional best practice standards, despite all asserting that they are. Most lack dedicated staff handling the underwriting, policy and reinsurance/retrocession agreement documentation, participant reporting, loss reserve management and claims administration of the pool. Many historically had no staff and did little to no underwriting, reporting or claims management, evidencing they were in fact sham pools created merely to attempt compliance with IRS 2002 safe harbor revenue rulings governing insurance tax diversification and distribution attributes.

The reason most risk pools are poorly designed and operated is simple – few people have the knowledge and experience to design, form and manage (with good process and procedural documentation and control) a micro-captive risk pool professionally. Even regulatory teams in many active captive jurisdications on and offshore lack the training, experience and processes to evaluate risk pools.

Costs of participating in pools varies from 1% of a participant captive’s gross premiums to 3% or more. Some have member and other service fees. Risk pools all vary on the amount of premium loss reserves they require be held under its control to timely process claims. Many are licensed operating insurance companies, many (historically most) are purely contractual pools. One form is not superior to the other when design and operated well.

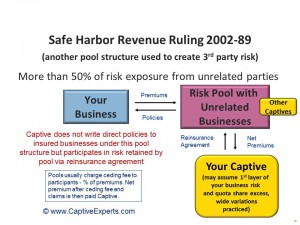

Many of the poorly designed and operated 3rd party risk pools have emerged over the past 15+ years to accommodate the growth in captive managers offering enterprise risk captives (known largely as micro captives or enterprise risk captives), most often structured to arguably qualify for the special 831(b) federal income tax incentive when such enterprise risk captives are insuring US based business risks. The following diagram shows one such risk pool structure with participating captives entering into reinsurance agreements with the risk pool:

Risk pooling is the least understood area in the captive industry today, even by most captive professionals. Care must be taken before deciding to participate in a risk pool, whether participating in a group captive program or needing 3rd party risk pooling in connection with forming your own enterprise risk micro-captive to formalize coverage of previously self insured risks.

Risk pooling is required in most cases for one of two simple reasons:

- To qualify as an insurance arrangement and get the benefit of favorable tax and accounting provisions afforded insurance companies, and

- To share risks with 3rd parties to improve risk management and reduce exposure to large unexpected losses.

Only a few short years ago, new domiciles including most US states new to captive licensing did not request risk pool related information where new captive applications indicted risk pooling was part of the captive design but the domicile did not regulate the associated risk pool. Some experienced regulatory staff now require risk pool documentation when pooling is part of the captive application under their review.

The types of coverage, the terms of coverage, the structure of risk sharing “buckets,” the underwriting process, risk pool operating policies and procedures, existence or lack of excess or reinsurance layer, the costs associated with risk pooling, historical and expected risk pool losses, risk pool claims and collateral procedures, etc., all vary between every captive risk pool program.

A word of caution – many if not most risk pools may not withstand regulatory or tax audit review. Any and all US owned or US insured coverage captive designs relying on such risk pool participation to qualify for special tax elections should consider our strategic captive review service to determine if changes are indicated. Most old micro-captives are likely in need of sunsetting, on a tax free reorganization basis when possible, and building a new state of the art risk management captive centric program indicated.